missouri gas tax increase 2021

1 until the tax hits 295 cents per gallon in July 2025. The bill would raise Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct.

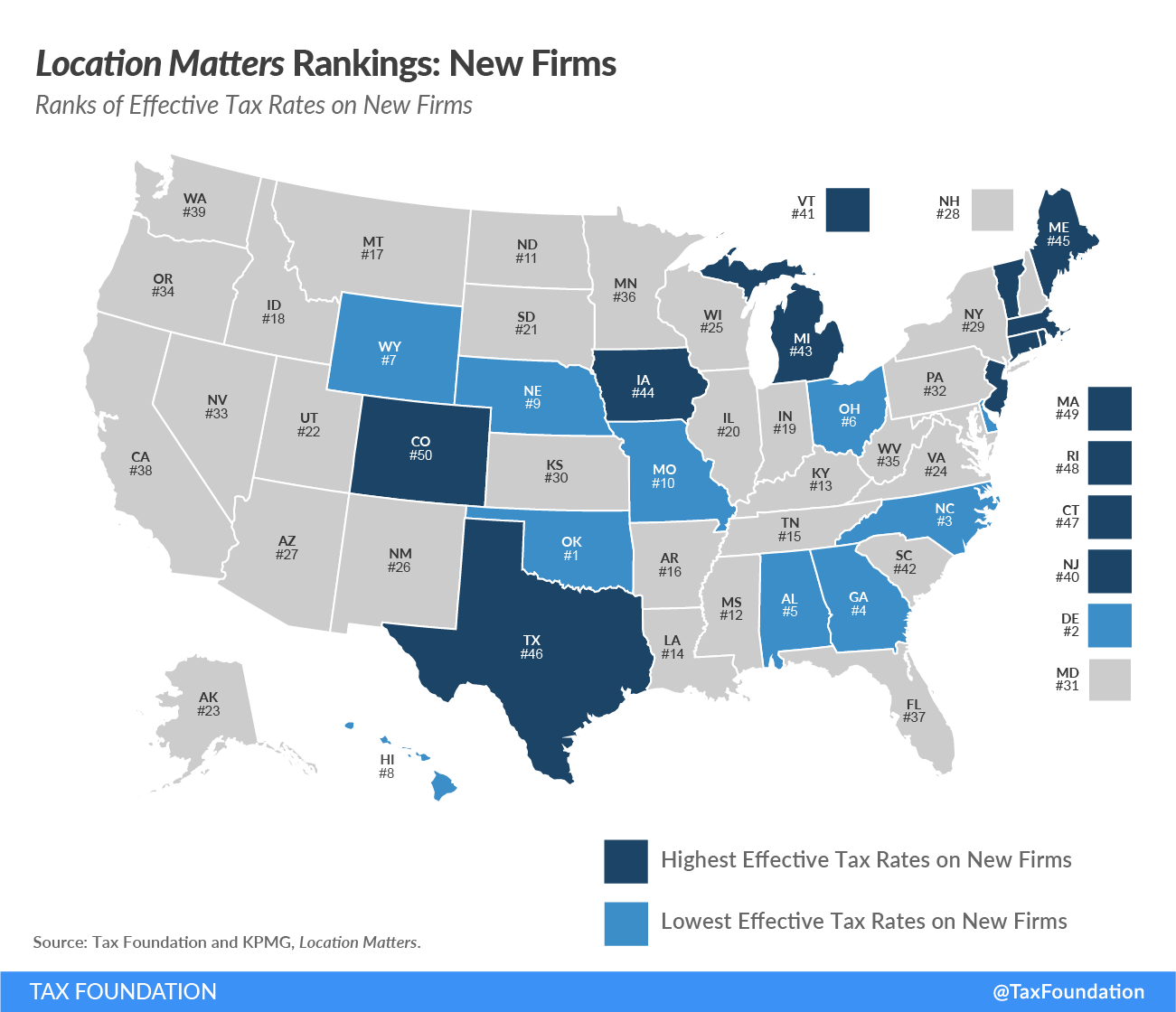

Missouri Tax Reform Missouri Tax Competitiveness

Mike Parson on Tuesday is expected to sign into law the states first gas tax increase in decades.

. May 12 2021 By Alisa Nelson. The bill includes a refund program for highway vehicles. Missouris first gas tax increase in a quarter century took effect Friday.

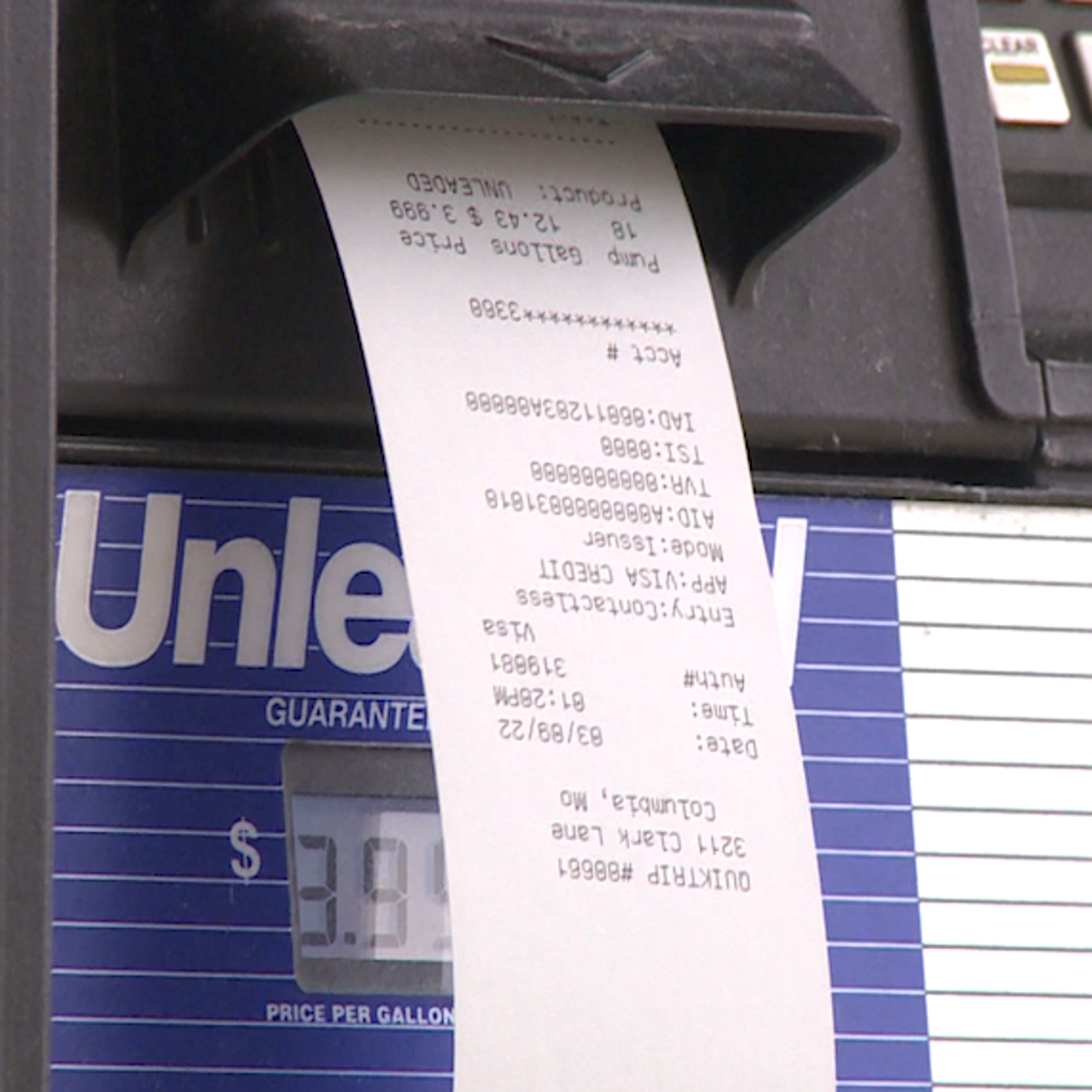

The legislation includes a rebate process where drivers could get a refund if they save their gas receipts and submit them to the state. A proposal up for consideration would raise the states gas tax 25 cents per gallon every year for the next four years generating a total of. Missouris gas tax will go up by 125 cents over the next five years 25 cents a year starting this October.

JEFFERSON CITY Mo. 2021 at 107 PM CDT Updated July 13 2021 at 210. Fuel bought on or after Oct.

KY3 - Missouris gas tax increase will go into effect on Friday. In this final week of the Missouri Legislatures regular session a proposed gas tax hike is expected to jump into the drivers seat. The bill raises Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct.

Governor Parson Signs Off On Missouris First Gas Tax Hike In More Than Two Decades. The Missouri Legislature has passed a proposal that would boost the states gas and diesel tax for the. Missouri lawmakers pass first gas tax hike in 25 years.

712022 6302023 Motor Fuel Tax Rate increases to 022. Senate Bill 262 increases the Missouri motor fuel tax rate over five 5 years by two and one-half cents per year with the first increase beginning on October 1 2021 and increases each year as follows. Senate Bill 262 increases the Missouri motor fuel tax rate over five 5 years by two and one-half cents per year with the first increase beginning on October 1 2021 and increases each year as follows.

LIEB May 12 2021. Fridays increase will bring Missouris gas tax to 195 cents. 1 drivers filling up in Missouri will pay an additional 25 cents per gallon of gas.

You may be eligible to receive a refund of the 25 cents tax increase you pay on Missouri motor fuel if. FILE - in this May 22 2014. 1012021 6302022 Motor Fuel Tax Rate increases to 0195.

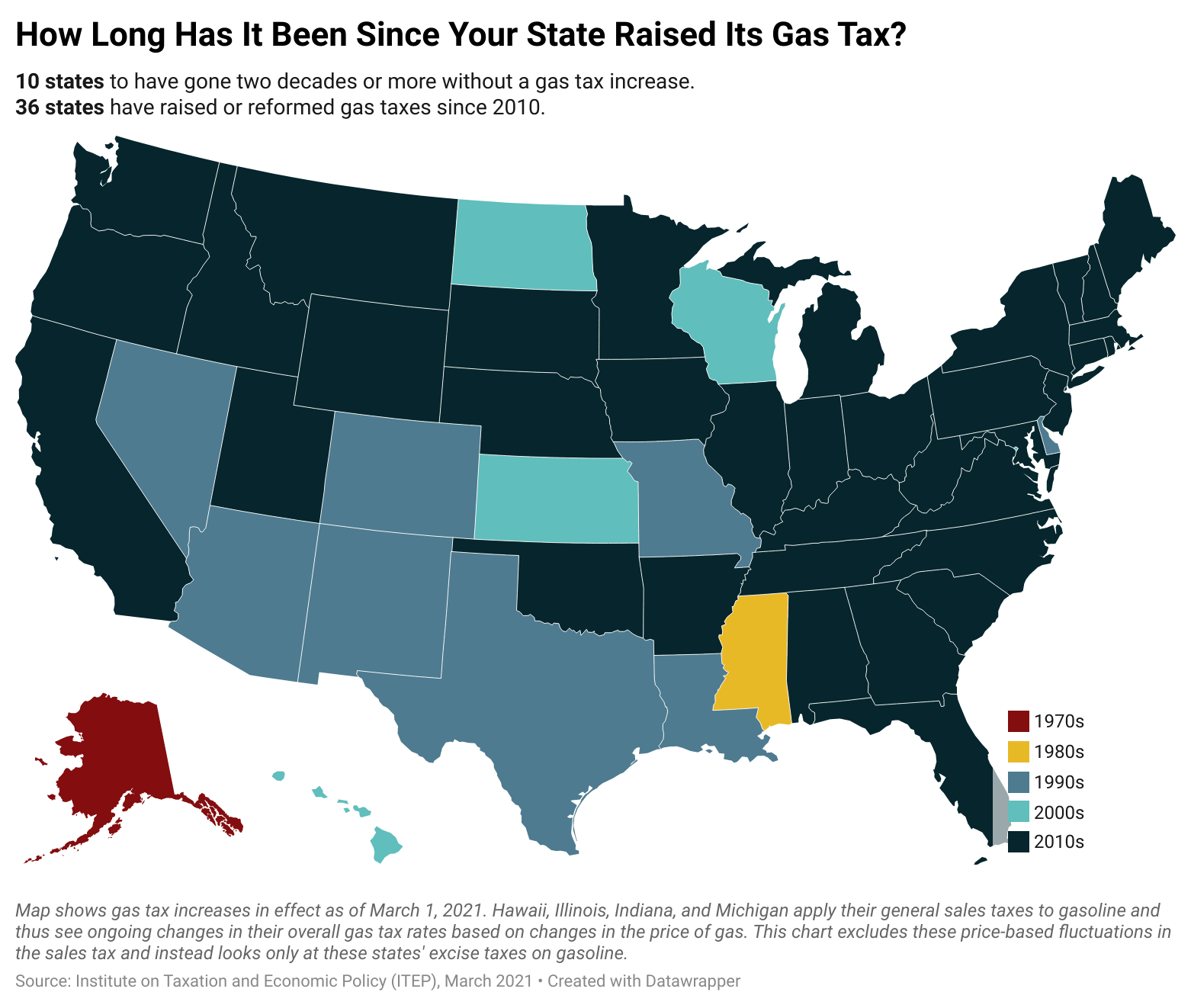

Missouri voters havent approved of a gas tax increase since 1996. File photo fuel prices at a gas station on US. Missouris gas tax could soon rise for the first time in 25 years after the states.

Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. On October 1 2021 Missouris motor fuel tax rate increased to 195 cents per gallon. 12 2021 in Rocheport photo courtesy of Missouri Governors Office.

Missouri has one of the lowest gas tax rates in. Prior to October 1 2021 the motor fuel tax rate was 017 per gallon. The bill will provide about 500 million more each year to the Missouri Department of Transportation for roads and bridges by increasing the gas tax by 25 cents.

169 are displayed between northbound and southbound traffic along Interstate 29 in St. 1 until the tax hits 295 cents per gallon in July 2025. There is a way for Missourians to get that increased tax money back though.

It is part of the gas tax bill lawmakers passed and Governor Mike Parson approved on July 13. May 10 2021 By Alisa Nelson. Starting Friday Oct.

On October 1 Missourians will see a price increase of 25 cents per gallon. The tax increase is expected to generate nearly 500. Gas tax increase The Missouri Senate also passed legislation on Thursday that would raise the states gas tax.

AP Missouri Gov. The House of Representatives. Governor Parson signed this into law back in May as a way to pay to fix.

The tax is set to increase by the same amount yearly between 2021 and 2025. 29 2021 at 503 PM PDT. Vehicle weighs less than 26000 pounds.

At the end of 2025 the states tax rate will sit at 295 cents per. The tax would go up 25 cents a year starting in. Vehicle for highway use.

Last Friday marked a noteworthy day at the gas pump in Missouri. For the first time in 25 years the states fuel tax a critical revenue source for transportation infrastructure is increasing. Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning October 1 2021 through June 30 2022 for motor fuel used for on road purposes.

By SUMMER BALLENTINE and DAVID A. 1012021 6302022 Motor Fuel Tax Rate increases to 0195. The gas tax is scheduled to increase 25 cents each year until 2025 when it would reach a rate of 295 cents per gallon.

1 2021 through June 30 2022. In that time period the tax rate has remained stagnant causing the.

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Missouri Lawmakers May Ask Voters To Raise Gas Tax In 2021 Transport Topics

Gas Tax Cut Again In Missouri Nextstl

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Missouri Department Of Revenue Plans To Offer Money Back On Gas Purchases Koam

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

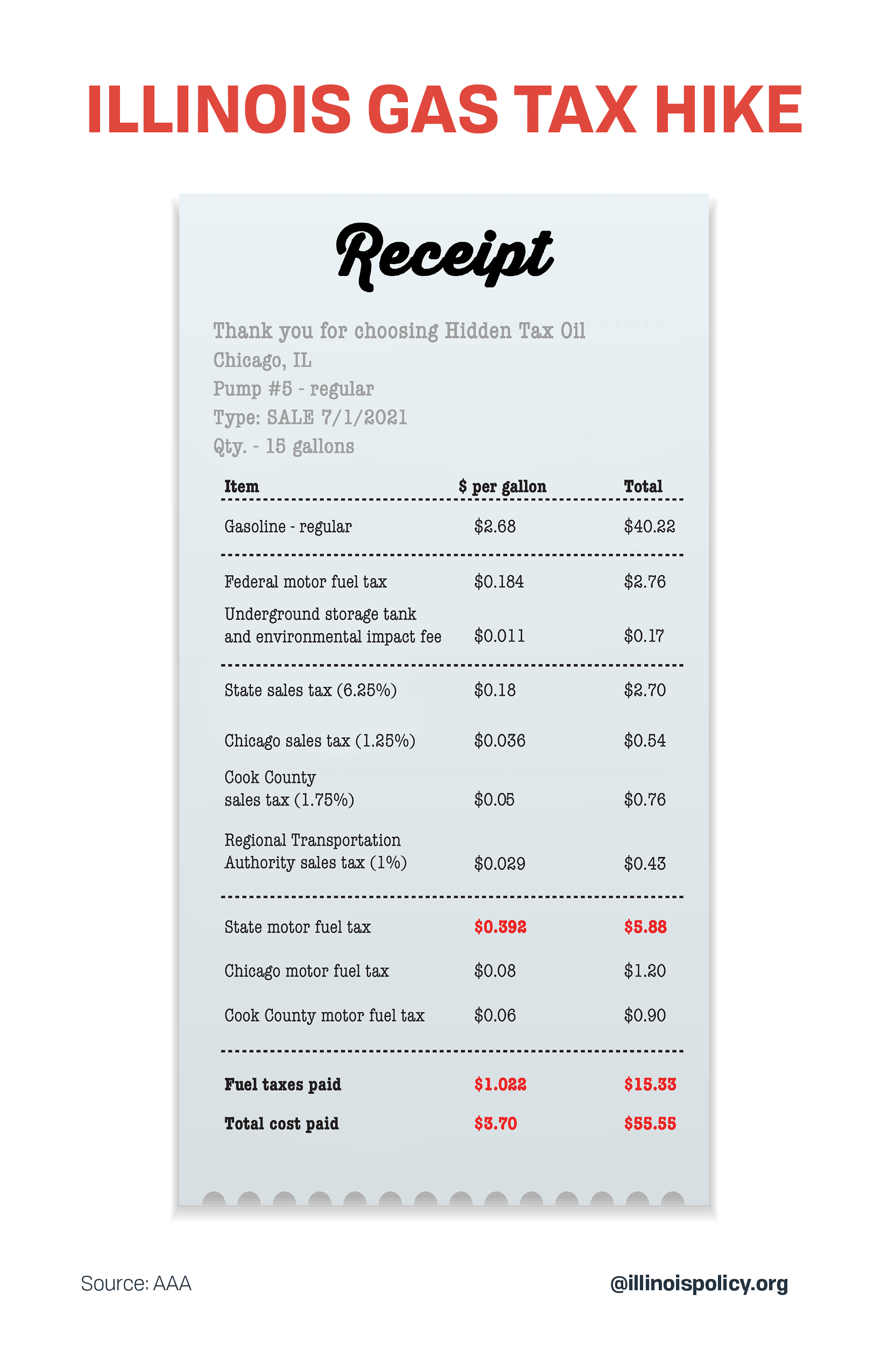

Illinois Doubled Gas Tax Grows A Little More July 1

Gas Tax Cut Again In Missouri Nextstl

Missouri Fuel Tax Increase Goes Into Effect On October 1

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Gas Tax Cut Again In Missouri Nextstl

Save Your Receipts Missourians Can Apply For Refund On State Gas Tax Increase Later This Year

Gas Tax Cut Again In Missouri Nextstl

Gov Mike Dewine Says Despite High Gas Prices It Would Be A Mistake To Roll Back Ohio Gas Tax Cleveland Com

Gas Tax Cut Again In Missouri Nextstl

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

/cloudfront-us-east-1.images.arcpublishing.com/gray/PH2KCKZOCZD3DDQBNWXZUA33RU.jpg)