s corp tax calculator excel

Select the cell you will place the. S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube.

Mobile Food Business Plan Template Check More At Https Sscresult2017 Bd Com Mobile Food B Marketing Plan Template Business Plan Template Spreadsheet Template

Please do as follows.

. Ad Payroll So Easy You Can Set It Up Run It Yourself. Calculate the return To enter S Corporation basis limitation Select the IncomeDeductions category Select the S Corporation Passthrough. After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship.

AS a sole proprietor Self Employment Taxes paid as a Sole. Total revenue is calculated by subtracting. Ad Payroll So Easy You Can Set It Up Run It Yourself.

But as an S corporation you would only owe self-employment tax on the 60000 in. Taxes Paid Filed - 100 Guarantee. Computers Tablets.

Personal Finance Tax Legal Software. Enter your estimated annual business net income and the reasonable salary you will pay. S-Corp Tax Savings Calculator.

S-Corp Savings Calculator I have an S-Corporation now. Find out how much you could save in taxes by trying our free S-Corp Calculator. Just complete the fields below with your best estimates and then.

As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. Our small business tax calculator uses the figures provided to estimate your tax expenses. A sole proprietorship automatically exists whenever you are engaging in business by and for yourself.

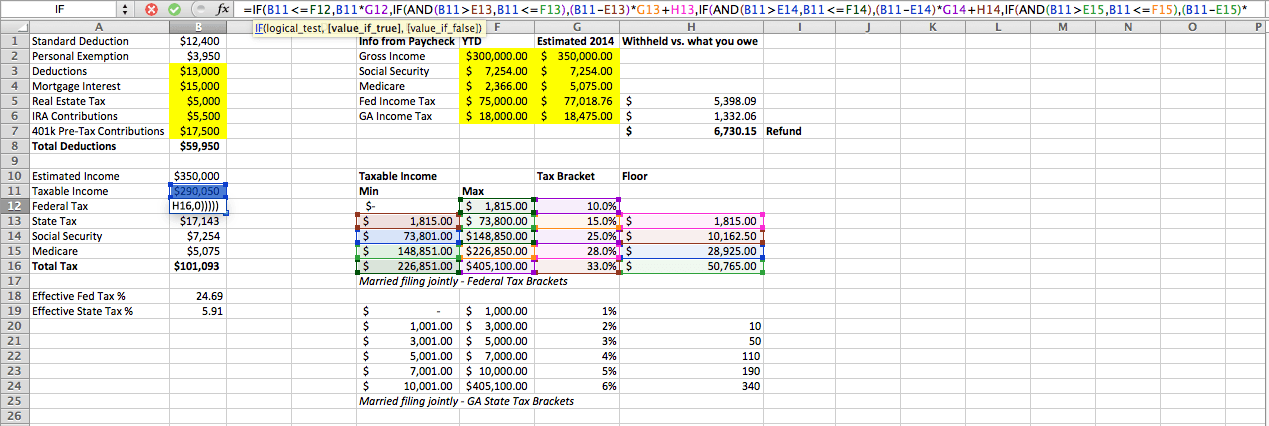

Over the years I have fine-tuned my Excel spreadsheet to require as little input as necessary especially when it comes to correctly calculate my income tax withholding based. S-Corp Business Filing And Calculator - Taxhub S-Corp Calculator Calculating Your S-Corp Tax Savings is as Easy as 1-2-3. How much can I save.

The basic corporate income tax calculator. S Corp Basis Worksheet UpCounsel 2020. From there well take your revenues and subtract out your expenses and then apply the correct tax.

This application calculates the federal income tax of the founders and company the California state franchise tax and fees the self-employment tax for LLCs and S-Corps pass-through. A new direct tax dispute settlement under Vivad se Vishwaas Scheme is introduced from FY2020-21. However if you elect to be taxed as an S-Corporation and take a 40000 salary with the remaining 30000 being a distribution to you or you keep it in the business you pay only.

Use this calculator to get started and uncover the tax savings youll receive as an S Corporation. Highlights of Changes in FY 2020-21 in Income Tax. 2019 S-Corporation Tax Organizer Spreadsheets Compile information for your S-Corp tax return with ease using one of our 2019 S-Corp Tax Organizers.

S corp tax calculator excel. No penalty will be. In the tax table right click the first data row and select Insert from the context menu to add a blank row.

Youre guaranteed only one deduction here effectively making your Self. Federal Income Tax and Employment Tax for LLCs and S Corporations Federal income tax applies to an individuals total revenue. Your business earns 100k in revenue and has 50k in business expenses thats a 50k profit on your form Schedule C.

Taxes Paid Filed - 100 Guarantee. Shareholders who have ownership in an s corporation must make a point to have a general understanding of basis. S corp tax calculator excel Friday March 25 2022 Edit.

Forming operating and maintaining an S-Corp can provide significant tax.

Effective Tax Rate Formula Calculator Excel Template

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

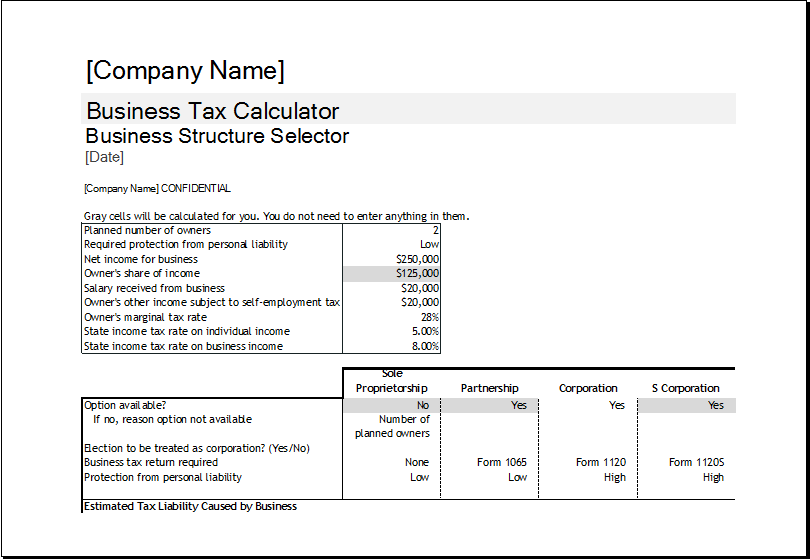

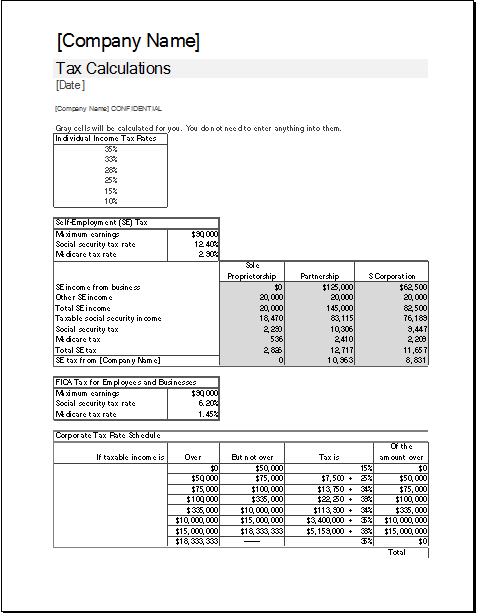

Corporate Tax Calculator Template For Excel Excel Templates

49 Make A Professional Report With These Free Download Income Statement Template Here Statement Template Income Statement Personal Financial Statement

Provision For Income Tax Definition Formula Calculation Examples

Independent Contractor Expenses Spreadsheet Free Template

How To Do Payroll For Single Member S Corporation Amy Northard Cpa The Accountant For Creatives Payroll Small Business Tax Small Business Bookkeeping

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Effective Tax Rate Formula Calculator Excel Template

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

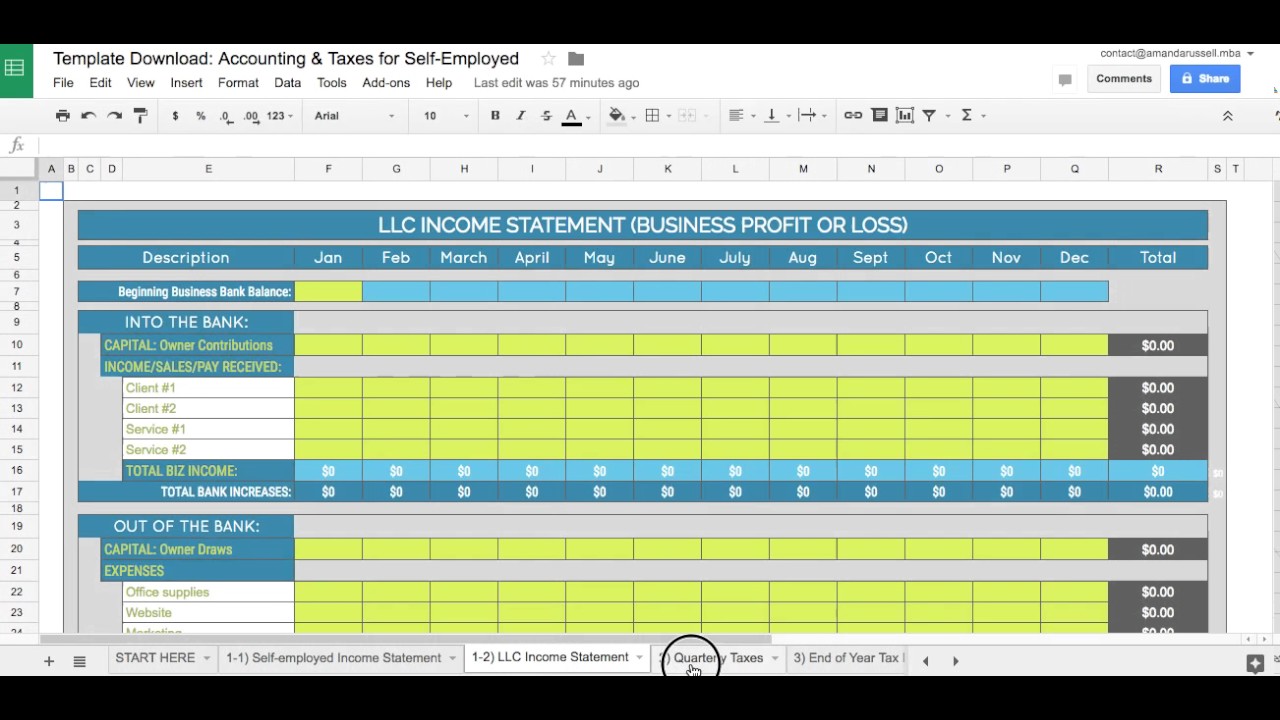

The Business Spreadsheet Template For Self Employed Accounting Taxes Llcs Youtube

How To Create An Income Tax Calculator In Excel Youtube

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

Corporate Tax Calculator Template For Excel Excel Templates

Accounting Excel Template Income Expense Tracker With Sales Tax